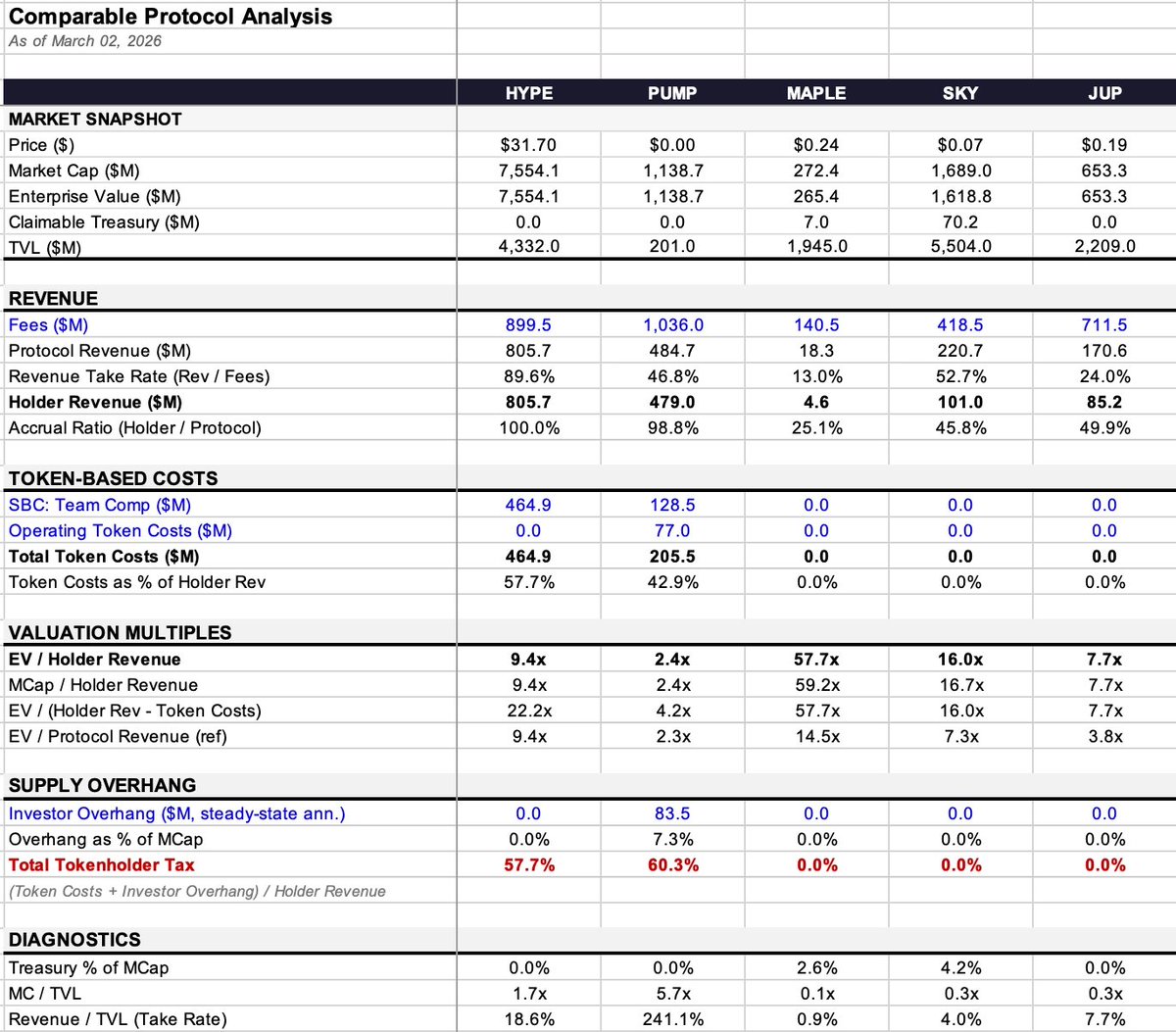

P/E ratios are a fine starting point for crypto valuations, but they miss balance sheets and capital structure.

So I adapted EV/EBITDA from tradfi for tokens. The core metric here is EV/Holder Revenue, or what you're actually paying per dollar that reaches you as a tokenholder.

I walk through five protocols $HYPE, $PUMP, $MAPLE, $JUP, $SKY as illustrations. The spreadsheet link is attached so feel free to swap in your own numbers or play around with it.

This is a prototype, not a finished product. If you find a better way to handle it, please publish it.

Controversial opinion: The biggest reason for the massive disconnect between crypto prices and crypto adoption is that 4 of the top 5 assets (by market cap) are largely uninvestable.

$BTC

- The quantum fear is not going away (even though it's a fairly easy technical fix, it's a much harder governance fix)

- It's not cool to own BTC now that blackrock and JP Morgan dominate it (see rise in $ZEC)

- It's not digital gold (in fact, actual tokenized gold exists)

- It's not scarce (endless derivs and structured products make the 21mm cap useless unless people start using physical bitcoin, which no one does).

- It's not an inflation hedge

- It's not a medium of exchange (stablecoins are)

$ETH & $SOL

- high inflation outweighing any fee capture (this is why market cap goes up while price goes down)

- Infinite blockspace relative to usage, with more L1 competition coming

- Fat protocol thesis on life support (and other than that thesis, no one has ever made a good argument for why L1s actually capture value)

- You need ~1000x more activity / transactions to warrant today's valuations (meaning SOL and ETH are not worthless, it's just VERY hard to justify their current valuations).

(For the record, I'm bullish on both Solana and Ethereum's prospects for further growth (relative to other L1s), I just don't think their tokens capture much value from that growth).

$XRP

- Literally the opposite of good token design. The token does absolutely nothing, and has virtually no linkage to Ripple

- Ripple sells ~$3-4 billion of XRP tokens per year to fund equity repurchases (people argue all day about the efficacy of token buybacks, yet no one seems to care that Ripple dumps tokens to buyback their own stock?)

This is why crypto is so broken. The entire industry was built on 4 assets that all suck as investments, which is why all of the exchanges and brokers cater only to fast money traders and macro funds/CTAs instead of real fundamental investors (even though fundamental investors make up the majority of the investor world).

Of these 4 assets, I'd say i'm most likely wrong about $BTC simply because it is entirely narrative/faith based, and that can change on a dime, plus BTC always goes up eventually. I find it impossible to underwrite Bitcoin as an investment, but I do understand why others like it.

Can this change? I hope so. It's very hard for an industry to grow when the top assets go down, but not impossible. It would require massive rotation (which is what we're seeing in equities right now -- a rotation out of Mag 7, private credit, and tech and into healthcare, energy, etc).

IMO, there are a LOT of good crypto investments right now that accrue value via the adoption of crypto and blockchain. Aligning your investments with the actual growth areas should work. Almost all of the growth and adoption of crypto and blockchain is happening in 3 financial areas:

1) Stablecoin/payments - harder to invest in pure plays, but there are some private stocks

2) DeFi -- tons of ways to capture this growth via equity-like tokens

3) RWA tokenizaton - while most of this value accrues to middlemen like Securitize and Blackrock, there are some pure plays as well.

If this industry pivots away from BTC ETH SOL XRP and memecoins, and into the stocks and equity-like tokens that fuel the growth of DeFi, payments and RWAs, then price will start matching adoption.

I think it's healthy for us in the Ethereum world to have a more bold and open mindset to many things, particularly on the application layer and on how we see ourselves in the world.

We should not compromise on core properties: censorship resistance, open source, privacy, security (CROPS). We should not have "open mindedness" of the type that leaves people with no confidence of what security properties the L1 will still have one year from now. We should not ask ourselves questions like "do we really need light clients to be able to trustlessly verify correctness of the chain?". But especially on the layer of applications and Ethereum's interface to the world, we should be more willing to radically rethink various concepts and step outside our comfort zone.

This includes issues of technological direction, eg. "what if AI basically means that wallets as browser extensions and mobile extensions are dead within a year?"

One example last year was the shift to thinking about privacy as a first-class consideration, something we value equally to the other types of security. This implies a radically different Ethereum application stack, because the entire stack so far has not been built around privacy. Great, let's build a radically different Ethereum application stack!

An example this year is the growing work on the networking side of privacy, both inside the EF and outside.

It includes application-layer issues, eg. "what if the rest of defi is basically just universal futures markets on top of a good decentralized oracle and letting users self-organize on top of that?", and "what if the ideal decentralized oracle is just a SNARK over M-of-N small LLMs over zk-TLSes of some major news sites?"

(BTW this is interrelated with the AI issue: one consequence of AI is that it moves "applications" away from being discrete categories of behavior with discrete UIs, and more toward being a continuous space, so "build fewer apps and rely on users to self-organize around them" should inevitably expand as a pattern)

One example this year is rethinking from zero the role of L2s, and what kind of L2s are actually most synergistic and additive to Ethereum.

It also includes culture. This is a big part of "the whole milady thing" for myself, @AyaMiyagotchi and others. Yes, it's a silly meme. Yes, I find the political takes of some milady partisans cringe and sometimes outright bootlickerish (though other milady partisans are quite the opposite). But the core underlying subtext, the message behind the message, is: rip off the suit and tie. If you have your suit and tie on, be willing to grab the nearest wine glass and spill it all over your suit and tie, so you have no choice but to rip it off and reclaim your body's full flexibility and freedom. Actually imagine yourself doing this the next time you get invited to a richpeopleslop formal gala dinner. Take the preconception that you are "respectable", write it down on a piece of paper, crumble it up and burn it. The psychological baptism of doing this leads to the intellectual baptism of unlocking greater creativity and expanding overton windows.

For too long, our algorithm in Ethereum has been: we have this existing ecosystem, what's the logical next step to make it one step better? Now, our algorithm should be: we have this L1 that is amazing and will become more amazing, we have a growing array of tools, both those built within our ecosystem and outside it, what are the most valuable things to build, knowing what we know now? If YOU had to write the section of the 2014 Ethereum whitepaper that talked about applications, and take a first-principles perspective of what makes sense in defi, decentralized social, identity, and elsewhere, what would you write? At least take the step of marking all path-dependence concerns down to zero, pretend for a brief moment that the Ethereum chain today has exactly zero usage and you're the one suggesting or building the first apps, and see what comes out. Do this even if you're the one building today's existing apps. This is how Ethereum can grow back stronger.

why has no lending market explored the idea of making the calculation of interest charged be dependent on the LTV of a loan

the riskier a loan, the higher the interest the borrower pays

afaik only protocol that has smth along these lines is Maker with ETH-A, ETH-B...

Crypto's tough state, brutal truths:

1)

AI poached the talent. Sentiment tanks not from price, but zero new builders. Cypherpunk narrative means not much to genz in the AI gold rush and global space race.

The memecoins mania disillusioned everyone

2)

Post FTX/Luna, we still tolerated grifters & casino culture instead of builders and actual entrepreneurial pragmatism.

Now they're "moving from crypto" (iykyk) to grift elsewhere, good riddance

3) Geopolitics, most westerners are painfully naive. "Credibly neutral" , WEF soyboy chase of UN-SDG era is over.

We've got a decade plus of sovereignty tools, but disconnected from reality's tradeoffs.

Prime example is Tornado ( I was a heavy user btw), it had to evolve into @0xprivacypools so we can exclude DPRK/IRGC without compromising on base-layer integrity. If you want to tolerate the intolerant, you're just champagne socialised Greta 2.0

4) No hype for ICOs/TGEs of L1s/pre-PMF experiments. Projects with longevity have to tie to utility in AI/Space/Longevity/Finance.

Embrace that Stablecoins + ETFs = DeFi consolidating into FinTech.

Reposition or slide into irrelevance

Just in the last 18 months. $1 Billion

How many of the below are winners?

The ones that launched a token:

Eigen Layer - $170m total raise! $500m Series B val → EIGEN now at FDV $350m

Layer Zero - $55m token buy + earlier rounds, $3B Series B val → ZRO now at FDV $1.9b

Babylon - $15m token sale → BABY now at FDV $130m

Walrus - $140m token sale → WAL now at FDV $400m

Jito - $50M strategic raise → JTO now at FDV 270m

Equity:

Phantom - $150m Series C, $3B val

Talos - $45m Series B, $1.5B val

Daylight - $15m

Series A/B:

XMTP - $20m Series B

Halliday - $20m Series A

Towns - $10m Series B

Seeds:

Kairos - $2.5m Seed

Cork Protocol - $5.5m Seed

Votre - $3.75m Seed

Seismic - $10m + $7m Seed

ZAR - $12.9m + $7m Seed

Inference - $11.8m Seed

Bastion Platforms - $14.6m

Shield - $5m Seed

Reflect - $3.75m Seed

TACEO - $5.5m Seed

Poseidon - $15m Seed

PrismaX - $11m Seed

Catena Labs - $18m Seed

KYD Labs - $7.1m

Miden - $25m Seed

Inco Network - $5m Strategic

ORO - $6m Seed

Glider - $4m

Mahojin - $5m Seed

Cambrian Network - $5.9m Seed

Ambient - $7.2m Seed

Legend - $15m Seed

Universal - $9m

Pod - $10m Seed

Merit Systems - $10m Seed

vlayer labs - $10m Pre Seed

OpenLayer - $5m Seed

OpenTrade - $7m Strategic

Loop Crypto - $2m Strategic

Launcher Capital - $4m Seed

Rumi - $4.7m Pre Seed

Oncade - $4m Seed

Sekai - $3.1m Seed

Scrypted - $1.5m Pre Seed

Mbd - $3m Pre Seed

Future Primitive - Strategic

Axal - $2.5m Pre Seed

Kraken Financial 获批美联储主账户,应该是Crypto首例,这个账户的重要性等于Crypto进入美元体系核心网络的门票。

随后美国银行业集体跳出来反对,从这一点来说,这已经威胁到他们的利益。以前,加密公司处理美元业务必须经过银行作为中介,现正在逐渐突破传统金融壁垒。

直接进入美元支付清算系统,不再需要依赖银行了。这个头开了,下一个可能是Ripple?Anchorage?

Noah makes very good points in this article, but I disagree with his defense of chargebacks given how they are structured today.

The thing everyone forgets is that while payment systems that allow chargebacks (like credit cards) protect consumers, they do the opposite to merchants.

The data on this varies, but something like 40 to 60 percent of all credit chargebacks are "friendly fraud", AKA people abusing the feature for something it wasn't meant for.

In what other context do we defend a solution this ripe with abuse? But cards perpetuate themselves due to a complicated mix of sticky behavior and anti-competitive collusion.

If people want insurance for their transactions (which I certainly do) they should just pay for it, like any other insurance. They would file claims much more judiciously if they did. It also doesn't make sense to make your local Deli pay for your loyalty to American Airlines.

Stablecoins are an opportunity to revisit this strange setup, first and foremost by elevating new payment systems that a corporation does not control (unless the network is permissioned).

Certainly if agents start useing stables, as Noah argues, that will open the door for their owners to start to too.

The other wildcard in this debate is whether the US government caps swipe fees like many other countries have. Now that we know Wall Street hates competition and is more than willing to use regulations to harm consumers, it would only be fair.

Whether regulators see crypto exchanges as public infrastructure or not,

And regardless of whether Upbit and Bithumb have done a good job or a bad one over the years,

Forcing the owners of large, established private companies to sell down their stakes is basically socialism.

If exchange ownership caps were the goal, that conversation should’ve happened when exchanges were first being built.

Korean regulators ignored or dismissed crypto for years, and now that the industry is big, they’re suddenly approaching it in a socialist way.

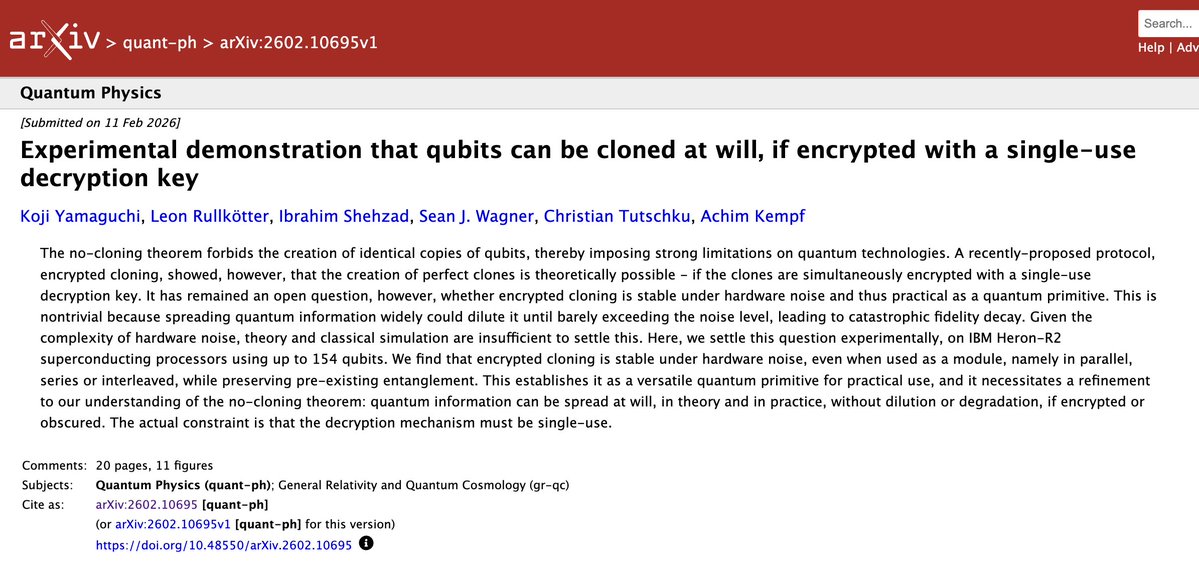

some researchers demonstrated that qubits can be cloned perfectly and at will, as long as each clone is encrypted with a single-use decryption key.

you can make unlimited redundant copies, but only ever recover one, since decryption consumes the key.

for blockchain / crypto, this opens a genuinely new primitive: quantum-native assets with cryptographic scarcity enforced by physics, not just software.

the most immediate application is quantum distributed storage - imagine a quantum ledger where your asset lives on 10 nodes simultaneously, fully encrypted, but only one can ever be unlocked and spent.

definitely not production ready, but interesting to see & follow

“crypto doesn’t have anything interesting”

yes, except:

- stablecoins

- self custody

- instant payments

- private money

- x402

- tokenized stocks

- tokenized collectibles

- perps on everything

- global 24/7 markets

- borderless savings accounts

- prediction markets

- crypto neobanks

- proof of humanity

- onchain reputation

- verifiable data ownership

- undercollateralized lending (soon)

but yea nothing interesting

Short-term bullish, long-term bearish Hyperliquid:

The bull argument:

- regulation = awareness

- regulation =/ permissionless trading (regarb, the real moat, is still in effect)

- most traders have no idea that perpetual futures even exist. this will undoubtedly introduce Hyperliquid to more users

- regulation is really just a dial that drives roadmap, but Hyperliquid needs to drive the dial, not Robinhood/CME. them investing in the Hyperliquid Policy center (run by ex-Variant CLO @jchervinsky, very bullish on this initative)

- Jeff and co. are still the preeminent system architects of good perps infrastructure, which is valuable even if existing products become commoditized

The bear argument:

- perp legalization without stablecoin clarity means the margin/collateral layer is still murky for compliant institutions

- Hyperliquid's core user (onchain degen) is a small TAM, and the users that legislation unlocks (e.g., options + future traders, institutions) will likely route through regulated wrappers before it reaches HL

- Robinhood + CME can build a comprable retail trading product to Hyperliquid. they could easily have similar/greater depth of liquidity if Citadel were involved. this will likely force Hyperliquid fees to compress

- traders + investors still don't care about custody and censorship. maybe eventually, but not today

If I had to guess how this plays out on a 5 year time horizon, I'd say the pie for perps grows, Hyperliquid overall OI and volume increases but as a % of total perps volume shrinks signficantly, and margins compress due to offchain competition.

明显感觉 @okx 在拥抱 Agentic Economy 的脚步快起来了。

这次新推出的OKX OnchainOS要主打全面Agent兼容,换句话说,以前OKX wallet要给“人”打造最好用的数字钱包,现在的OnchainOS目标是给未来的“AI Agent”打造一套数字操作系统。

为什么这么做,就像 @zakk_okx 老板所说,OnchainOS不单纯是一个新产品,而是一个面向开发者集团战略升级的标志。

我再补充谈两点看法:

1)OKX Wallet、OKX DEX之前是在多链适配和流动性聚合上“卷出来”的硬实力。但说实话,在增量不足的当下,单纯服务“人”很吃亏,毕竟用户池就那么大,还缺乏忠诚度。只靠上新币、领空投、新链支持等碎片化热点里反复横跳很难体现出优势。

而服务Agents就不一样了,这会是全新比拼infra迭代速度的新赛道,目前竞品极少,抢先布局必然能再次获得先发优势;

2)之前OKX Wallet压倒MetaMask等钱包靠的是精美的钱包UI界面和丝滑的用户体验,但Agent不需要这些。它需要的是标准化的API调用、极低的响应延迟和自动化的执行环境。这是一套全新的课题,对团队的技术底蕴提出了更高要求。

这恰好符合OKX一向主打技术Infra导向的底色,能否抓住这次Agent给Crypto提出的全新infra迭代逻辑,能不能在这场抢夺AI Agent新流量入口的战争中获得胜利,对OKX和 @XLayerOfficial 这条新链而言都太关键了,赢了就不仅仅是某个“产品”的成功了,而是一次“全生态”洗牌的机会;

I love this post. Ethereum is the World Computer. Free finance is one important use of the World Computer, if we can police our own to actually keep the finance free. However, you can do so many more things with a computer, so we must never stop dreaming big. In a world gone mad, the Infinite Garden is a sanctuary.

Picture Ethereum's role as the unstoppable coordination layer of all liberatory technology in a movement of broader d/acc. The leviathan we defend against is very powerful. In the mundane case, state capacity for oppression might trend towards infinity. In the extreme case, our civilization might actually birth a self-assembling exocapital computer eschaton.

We might need to survive in the Miyazaki patchwork future, where we can yet live in self-sovereign off-grid Fortress New Hampshire network states despite an all-powerful malevolent adversary. Our hardware and software can be formally verified to be mathematically airtight. Our air, water, and food can be locally-generated and protected from supply-chain attack. Our printers will produce the plows, swords, ghost guns, and any other tools of production or defense. Our locally-operated computer katechons can save us from a perpetual onslaught of drones, cyberattacks, and bioweapons.

In such a most-adversarial world, Ethereum is the layer which allows for safe communication and trade between sanctuary islands. It is the layer which helps those create new sanctuary islands. The unstoppable forever network will see the preservation of human agency into the stars and beyond.

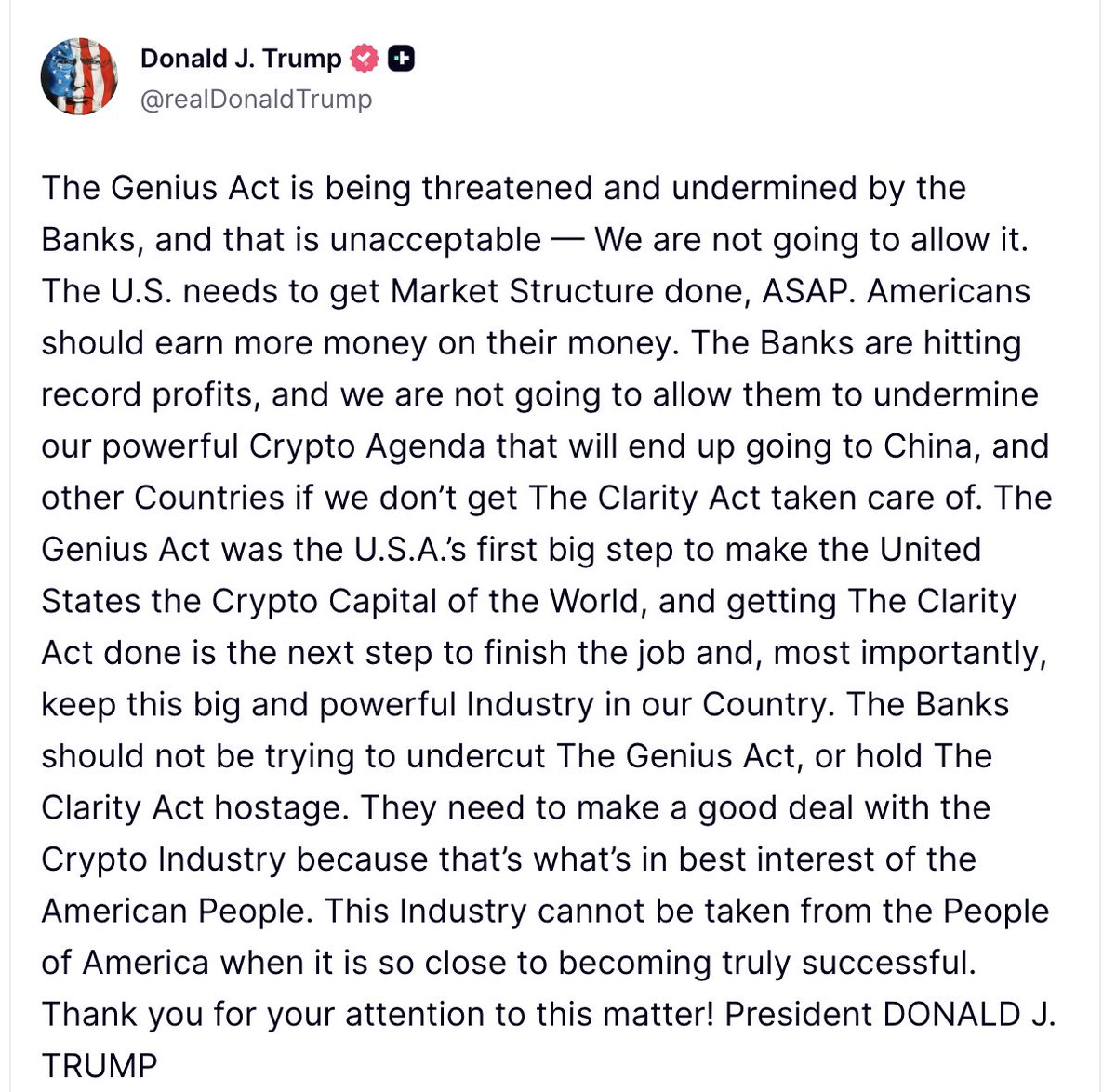

Glad to see that the President lands on the side of logic and sanity on the stablecoin yield issue. Banks make plenty of money. American savers deserve options. Competition is good. If selfish anti-American Wall Street lobbying kills crypto progress then foreign jurisdictions prevail.

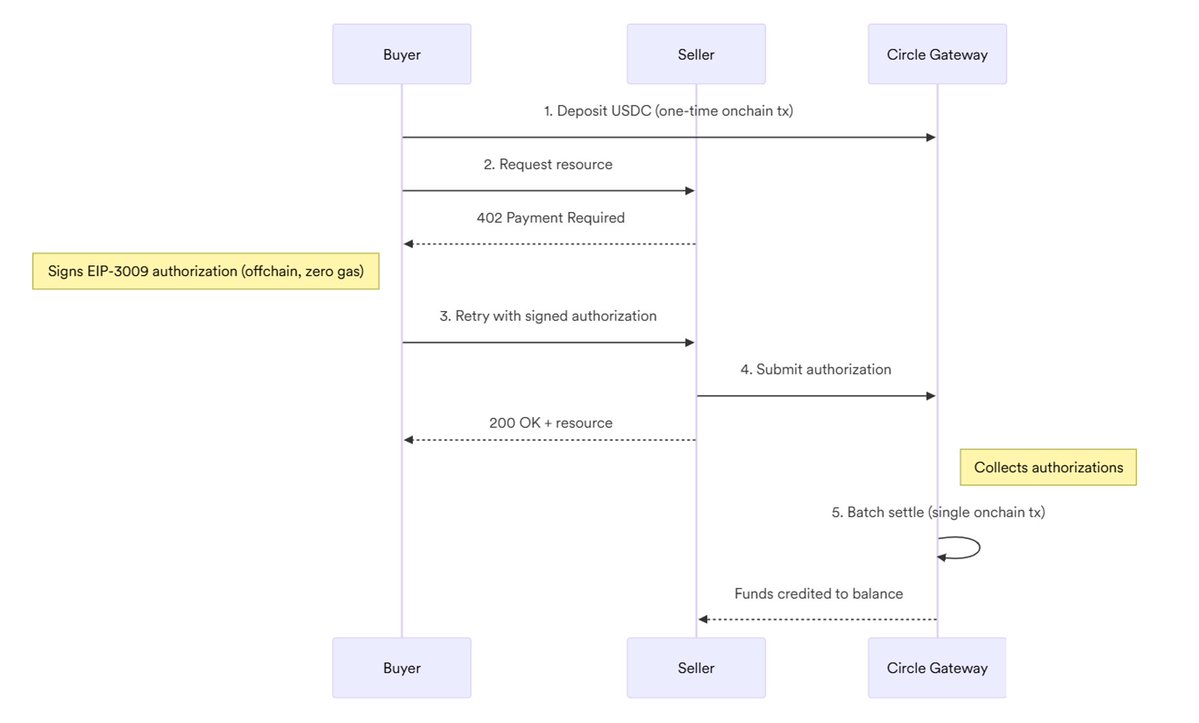

How do Circle’s Nanopayments work?

@circle has unveiled a new feature called Nanopayments.

It allows transfers as small as $0.000001 while claiming zero gas fees. How is that possible?

The secret lies in batched settlement.

If every payment created its own onchain transaction, gas costs would quickly add up.

Instead, Nanopayments collects users’ offchain payment signatures through the Circle Gateway. The system calculates net balances and periodically settles accumulated payments in a single batch.

How Nanopayments Work

Here is a simplified look at the process:

1. Deposit: The buyer sends USDC from their wallet to the Circle Gateway Wallet. This is an onchain transaction and gas is paid only once at the initial deposit.

2. Request and negotiate: The buyer requests a paid resource from the seller. The seller can respond through the x402 protocol.

3. Sign authorization: The buyer signs an EIP-3009 message. This is an offchain signature that authorizes payment to the seller and requires no gas.

4. Settle and serve: Circle Gateway verifies the signature and checks the buyer’s balance. The corresponding amount is locked. The seller immediately delivers the paid resource to the buyer.

5. Batch settlement: The Gateway periodically aggregates pending offchain signatures, calculates net balances, and settles them onchain in a single transaction.

In other words, thousands of offchain payment transactions are consolidated into one onchain transaction. That is why the effective gas cost approaches zero.

Security Model

One point worth highlighting is that the offchain payment authorization process might appear custodial at first glance. However, Circle Gateway is designed to be non custodial.

Circle Gateway runs inside an AWS Nitro Enclave TEE. Within this environment, the system verifies EIP-3009 signatures, computes batch settlement results, and signs the final batch transactions. The TEE signing keys are securely protected using AWS KMS. Even Circle employees cannot access the enclave or the keys.

Thoughts

There have been many attempts to implement micropayments. Most approaches simply relied on sending transactions on networks with extremely low gas fees.

Nanopayments takes a different path. By aggregating offchain transactions and processing them in batches, it dramatically reduces gas costs. (For reference, the USDT chain @Stable has implemented a similar concept at the network level called the USDT Transfer Aggregator.)

This approach could become especially meaningful in the future. As the agentic economy evolves, AI agents may increasingly stream payments in real time. Nanopayments creates the infrastructure that makes that model viable.

Over the past year, many people I talk to have expressed worry about two topics:

* Various aspects of the way the world is going: government control and surveillance, wars, corporate power and surveillance, tech enshittification / corposlop, social media becoming a memetic warzone, AI and how it interplays with all of the above...

* The brute reality that Ethereum seems to be absent from meaningfully improving the lives of people subject to these things, even on the dimensions we deeply care about (eg. freedom, privacy, security of digital life, community self-organization)

It is easy to bond over the first, to commiserate over the fact that beauty and good in the world seems to be receding and darkness advancing, and uncaring powerful people in high places are making this happen. But ultimately, it is easy to acknowledge problems, the hard thing is actually shining a light forward, coming up with a concrete plan that makes the situation better.

The second has been weighing heavily on my mind, and on the minds of many of our brightest and most idealistic Ethereans. I personally never felt any upset or fear when political memecoins went on Solana, or various zero-sum gambling applications go on whatever 250 millisecond block chain strikes their fancy. But it *does* weigh on me that, through all of the various low-grade online memetic wars, international overreaches of corporate and government power, and other issues of the last few years, Ethereum has been playing a very limited role in making people's lives better. What *are* the liberating technologies? Starlink is the most obvious one. Locally-running open-weights LLMs are another. Signal is a third. Community Notes is a fourth, tackling the problem from a different angle.

One response is to say "stop dreaming big, we need to hunker down and accept that finance is our lane and laser-focus on that". But this is ultimately hollow. Financial freedom and security is critical. But it seems obvious that, while adding a perfectly free and open and sovereign and debasement-proof financial system would fix some things, but it would leave the bulk of our deep worries about the world unaddressed. It's okay for individuals to laser-focus on finance, but we need to be part of some greater whole that has things to say about the other problems too.

At the same time, Ethereum cannot fix the world. Ethereum is the "wrong-shaped tool" for that: beyond a certain point, "fixing the world" implies a form of power projection that is more like a centralized political entity than like a decentralized technology community.

So what can we do? I think that we in Ethereum should conceptualize ourselves as being part of an ecosystem building "sanctuary technologies": free open-source technologies that let people live, work, talk to each other, manage risk and build wealth, and collaborate on shared goals, in a way that optimizes for robustness to outside pressures.

The goal is not to remake the world in Ethereum's image, where all finance is disintermediated, all governance happens through DAOs, and everyone gets a blockchain-based UBI delivered straight to their social-recovery wallet. The goal is the opposite: it's de-totalization. It's to reduce the stakes of the war in heaven by preventing the winner from having total victory (ie. total control over other human beings), and preventing the loser from suffering total defeat. To create digital islands of stability in a chaotic era. To enable interdependence that cannot be weaponized.

Ethereum's role is to create "digital space" where different entities can cooperate and interact. Communications channels enable interaction, but communication channels are not "space": they do not let you create single unique objects that canonically represent some social arrangement that changes over time. Money is one important example. Multisigs that can change their members, showing persistence exceeding that of any one person or one public key, are another. Various market and governance structures are a third. There are more.

I think now is the time to double down, with greater clarity. Do not try to be Apple or Google, seeing crypto as a tech sector that enables efficiency or shininess. Instead, build our part of the sanctuary tech ecosystem - the "shared digital space with no owner" that enables both open finance and much more. More actively build toward a full-stack ecosystem: both upward to the wallet and application layer (incl AI as interface) and downward to the OS, hardware, even physical/bio security levels.

Ultimately, tech is worthless without users. But look for users, both individual and institutional, for whom sanctuary tech is exactly the thing they need. Optimize payments, defi, decentralized social, and other applications precisely for those users, and those goals, which centralized tech will not serve. We have many allies, including many outside of "crypto". It's time we work together with an open mind and move forward.

You have zero control over where you're born, yet billions of people in the world are shut out of accessing financial tools because of it.

Finally, this is changing with crypto. Getting access to sound money, loans, stocks, etc from your phone anywhere in the world is foundational to progress.

I used to hate the idea of borrowing against your Bitcoin

But I was presented with new information and completely changed my mind

I used to think that you should just sell Bitcoin to buy the things that you need if you don't have enough income

But now I understand that most people won't care about Bitcoin until it's $1M+

Most of the Bitcoin supply will be bought by institutions until it reaches $1M+

The institutional investors who understand Bitcoin will never sell

For example, Strategy is building products that allow it to essentially print fiat so it can get as much Bitcoin as possible

Why should I sell my Bitcoin to Strategy?

Why should I pay the taxes associated with selling my Bitcoin?

Why should I pay the exchange fees to sell my Bitcoin?

If someone wants to be paid in Bitcoin, I will gladly give it to them over fiat

But if I have to sell my Bitcoin to buy the things that I need, then I would rather just borrow fiat against a very small portion of my stack and pay that loan back with devalued dollars

Of course, there are still risks associated with borrowing against your Bitcoin

It's still a relatively new asset class, so it's very volatile

You could be liquidated and lose your entire stack if you borrow against everything you have

I think it would be smart to limit the percentage that you borrow against

The limit would be up to you

Think about how much Bitcoin's price could fall before you make your decision

Eg. Borrowing against 5% of your stack with a loan-to-value of 50% means you can only get liquidated if Bitcoin's price sees a 96%+ drawdown

Borrowing against 50% of your stack with an LTV of 50% means you would get liquidated with a 67.5% drawdown

This is with a liquidation LTV of 80%

The lower your LTV, the safer your loan

Most people won't understand the significance of Bitcoin until fiat is dead

At that point, they won't be buying it

They will be working for it

在 Uniswap 在诈骗代币集体诉讼案 (Risley v. Uniswap Labs)中的法官 Katherine Polk Failla ,也是负责 SEC 诉 Coinbase 案的法官,在裁决书中有几个关键观点:

- Uniswap 提供的只是基础协议(底层代码)。就像汽车制造商不为酒驾司机负责、软件开发者不为利用该软件进行的诈骗负责一样,Uniswap Labs 不应对第三方发行的垃圾币(Scam Tokens)承担赔偿责任。

- 无法确定被告。诈骗者通常是匿名的。原告因为找不到真正的骗子,转而起诉“有钱且有名”的平台方,法院认为这在法律上是站不住脚的。

- 法律监管的真空。目前的联邦证券法并不能涵盖这些去中心化协议的行为。如果原告觉得不公平,应该去找国会修法,而不是让法官“硬套”现有的证券法。

Uniswap 胜诉的关键在于其核心智能合约是去中心化且不可更改的。

如果协议保留了过大的“管理员权限”(Admin Keys)来控制交易、冻结资产,法官可能会认为这是一个“中心化实体”,从而让你承担监管责任。

也就是 代码越自治,开发者越安全。

而在这之前还有一个诉讼案件受人关注,那就是 Tornado Cash被指控 洗钱、违反制裁规定 (OFAC),最后开发者因“未能阻止非法资金流”面临刑事指控

目前,美国的法律体系对证券法领域的 DeFi 创新相对宽容(倾向于认为代码无罪),但对 “反洗钱/金融制裁” 领域则非常严苛。

日历

3 月 8 日

数据请求中

copyright © 2022 - 2026 Foresight News